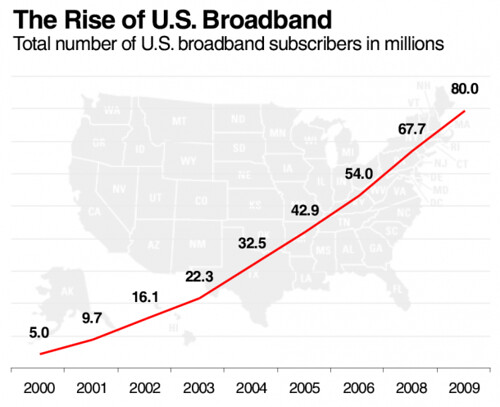

More than a billion people now use the internet. Most broadband users access it through land lines. The world’s 4.6 mobile subscribers are now moving to smartphones and high speed data. Broadband wireless is the next big thing.

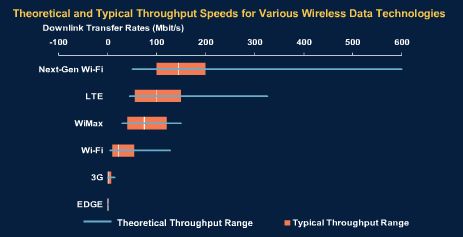

A “4G” system (with 1-10 Mbps speeds), is designed to meet the demand. Operators get more people to share a cell site. Consumers get more bang for the buck.

WiMAX and LTE are locked in a world-wide battle. A trillion dollar market is on the line.

WiMAX, with no legacy to support, wants to topple the cellular oligarchies using fast, cheap architecture modeled after Wi-Fi. Cellular-backed LTE, with overwhelming support from cellular operators, looks to be the late-starting favorite.

Juniper predicts 50 million WiMAX subscribers globally by 2014 with LTE subscribers exceeding 100 million by 2014. But projections are all over the map. It’s anyone’s game. One thing is clear: “4G” has arrived.

Commercial “4G” service is available now. Clear now covers close to 30 million people in the United States with Mobile WiMAX. Sweden’s Telenor launched the world’s first LTE this December. Verizon plans to offer “4G” LTE service in 25 cities by 2010.

1. WiMAX Defined (1999-2004):

At the beginning of the decade, a lot of people wanted to extend the range of WiFi. It sold a lot of laptops for Intel and delivered real value for consumers.

The key to WiFi’s success was a simple Time Division Duplex protocol and flat IP architecture. A basestation could be plugged into a DSL line. Simple. Cheap.

The key to WiFi’s success was a simple Time Division Duplex protocol and flat IP architecture. A basestation could be plugged into a DSL line. Simple. Cheap.

The goal of WiMAX was to extend WiFi-like service to an entire community. It would use inexpensive components and utilize licensed or unlicensed frequencies.

Roger Marks founded the IEEE 802.16 Working Group in 1998, and has chaired the 802.16 committee ever since. It completed the first WirelessMAN air interface standard in 2001 (for use above 10 GHz), and approved 802.16a, the original Wi-Max spec, in January, 2003. It was followed by the 802.16d (fixed) standard in 2004, which consolidated the previous standards and added MIMO support. In December 2005, the mobile spec was approved (802.16e).

WiMAX combines WiFi speeds with cellular range. It uses the (licensed) 2.3 Ghz, 2.5 Ghz and 3.5 Ghz as well as the unlicensed 5.8 Ghz and 3.65 GHz bands. It plugs into Ethernet – like WiFi. It supports roaming voice and high speed data – like cellular.

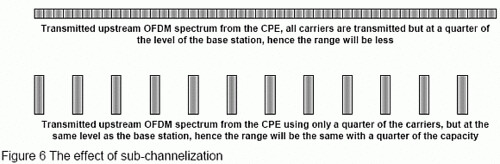

The IEEE used every trick in the book for Mobile WiMAX. The number of subcarriers in Scaleable OFDM could be adjusted dynamically. For weaker indoor reception, a Mobile WiMax client uses fewer (but stronger) subcarriers with rugged QPSK modulation.

With subchannelization, MIMO antennas and beam forming, coverage increased from 2km to 9km, a twenty-fold increase in coverage and subscribers. It wasn’t perfect. The Scalable OFDM carrier of Mobile WiMAX “broke” compatibility with fixed 802.16-2004, but it gained global acceptance. The WiMAX Forum formed to promote the standard and monitor interoperability between vendors.

Lucent, Ericsson and Nokia were dismissive. Their vendor specific, turnkey solutions for cellular carriers required lots of proprietary gear. But HSDPA could only fit about ten customers per segment, or 30 per base station. Mobile WiMax – in many ways just a glorified access point – could easily double the data rate and subscriber count – at a quarter the cost, claimed its supporters.

WiMAX was WiFi on steroids. All it needed was spectrum.

2. McCaw buys up 2.6 GHz (2003-2005): “We aren’t trying to eat someone’s lunch, but make the pie bigger,” proclaimed Craig McCaw in October, 2004. But McCaw had been buying up 2.6 GHz spectrum over the past year.

“We aren’t trying to eat someone’s lunch, but make the pie bigger,” proclaimed Craig McCaw in October, 2004. But McCaw had been buying up 2.6 GHz spectrum over the past year.

Some 200 Mhz, between 2.5 and 2.69 GHz, was largely unused by the educators and wireless cable operators to whom it was assigned. McCaw was right behind Sprint and Nextel in MMDS spectrum ownership. The FCC altered the MMDS Band rules somewhat to lower potential interference from higher power television transmissions. McCaw also partnered with European operators on auctions of 3.5GHz spectrum.

Then McCaw bought NextNet, a pre-WiMAX equipment maker, to create the hardware to use the band and already owned XO, a fixed broadband wireless backhaul company. Money wasn’t a problem. McCaw founded the first US cellular network, McCaw Cellular, and sold it to AT&T in 1994 for $11.5bn, then turned around Nextel, flipping it for billions more.

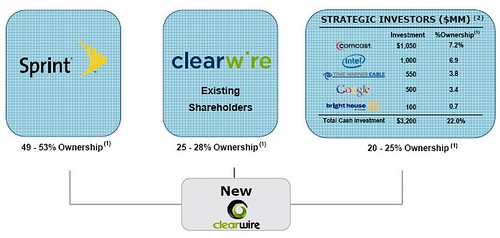

By 2004, Clearwire, Sprint and Nextel owned most of the 2.6 GHz spectrum in the United States. The merger of Sprint and Nextel brought their spectrum together and McCaw did a spectrum sharing deal with Sprint, bringing it under one broadband tent.

McCaw had most of the pieces in place by 2005. In August 2006, Sprint committed to WiMAX for its “4G” system.

3. WiMAX Launches (2004-2008):

The first 802.16a-like implementation in the United States was installed in December, 2003, by VeriLAN in Portland, Oregon. They used 5.8 GHz Wi-Lan gear, on a television tower. It traveled some 10 miles to feed a Vivato phased array that covered downtown Portland.

Verilan provided DailyWireless with free broadband wireless service for a Wireless Bike Project to provide WiFi access at the opening of the Interstate Max light rail line in Portland.

While fixed 802.16d can feed remote hotspots, Mobile WiMAX (802.16e) is targeted at consumers, delivering 1-10 Mbps to laptops, with WiMAX phones expected in 2010. Mobile WiMAX, with basestations every 1-3 sq miles, allow 200 mWatt clients to work indoors. Seamless handoff provides reliable voice and data.

Sprint launched the first Mobile WiMAX service in October, 2007, in Baltimore Maryland. Branded Xohm, the service was renamed Clear after the Wimax partnership with cable operators and Sprint was approved.

Clear’s Mobile WiMAX service is now available with no long-term contracts to 30 million people, with service available in Atlanta, GA; Baltimore, MD; Boise, ID; Chicago, IL; Las Vegas, NV; Philadelphia, PA; Charlotte, Raleigh, and Greensboro, NC; Honolulu and Maui, HI; Seattle and Bellingham, WA; Portland and Salem, OR; and Dallas/Ft. Worth, San Antonio, Austin, Abilene, Amarillo, Corpus Christi, Killeen/Temple, Lubbock, Midland/Odessa, Waco and Wichita Falls, TX.

WiMAX deployments has reached 518 networks in 146 countries, with almost two million mobile WiMAX subscribers expected by the end of 2009, says ABI Research. By the end of 2010 WiMAX Forum projects that WiMAX technology will cover at least 800 million people while Clear plans to reach about 120 million people by then.

By 2010, Clearwire hopes to have 4.6 millon subs in the United States and close to 20 million subs by 2014.

4. 4G Spectrum (2006-2010):

While Verizon plans LTE in the 700 MHz band, most global operators are eyeing the 2.5MHz-2.69MHz band for “4G” service. Most are preparing to auction off 200 MHz in the 2.6 GHz band. EU countries, including Austria, France, Germany, Italy, the Netherlands, Portugal, Spain and the United Kingdom will use the CEPT plan which generally divides the 200MHz of spectrum available in the 2.6Ghz band into a 140 MHz block dedicated to FDD systems (targeted at cellular-based LTE) and a 50 MHz TDD block (targeted at WiMAX). The 790-862 MHz band is also being eyed by the EU, as spectrum is freed up during the digital television conversion.

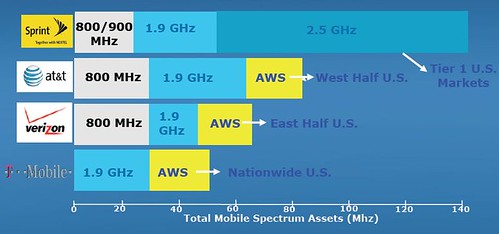

In the United States, Clear has one thing that cellular operators don’t have (besides a working “4G” system); 120 Mhz of greenfield spectrum. They already own most of the 2.6GHz band. That leaves cellular operators with the 700MHz and the AWS band for “4G” deployment. But that only opens up 20-40 Mhz. Total.

Verizon plans LTE dongles next year. Today a typical 3G monthly mobile broadband plan for a netbook or dongle costs $60 a month. Cellular-based LTE seems unlikely to offer unlimited 6 Mbps service for $40/month like Clear.

They don’t have the spectrum. Their current cellular channels are near capacity.

Today, there are 500 million mobile phone subscribers in India, but only 7.4 million have access to broadband connections. The WiMAX Forum called for the Indian government to enable the 2.5 GHz auction to happen on schedule in January 2010 and take steps to release spectrum for WiMAX deployments in the 2.3/2.5 GHz frequency bands. The Indian auction was postponed until mid-Feb 2010. India’s Department of Telecommunications announced in Aug 2009 that it will issue four 3G and three WiMAX spectrum slots nationwide. The auctions are expected to fetch more than INR250 billion (US$5 billion). According to Infonetics Research, WiMAX will accrue nearly 28 million Indian subscribers by 2013 – exceeding the combined WiMAX subscribers in Brazil, China and Russia. Maravedis predicts 13 Million WiMAX Subscribers in India by 2013.

BSNL, Tata and Bharti Airtel are currently deploying WiMAX in the 3.5 GHz band, but the new 2.2-2.3 Ghz band, should lower costs and improve service.

Analyst Alan Weissberger believes that pure performance and coverage are insufficient by themselves to attract a large number of subscribers to WiMAX. Barry West, president of Clearwire International, says WiMAX users currently average around 1 gigabyte per month, and he expects the average consumer will use 14 gigabytes per month in the near future.

Spectrum is key. The big 2.6 GHz auctions next year should largely define the look of the “4G” world.

5. LTE defined (2008):

Next generation networks are all based upon Internet Protocol (IP). In 2004, 3GPP proposed IP as the future for next generation networks and began feasibility studies in what became Long Term Evolution (LTE) the “4G” system for cellular operators.

In December 2008, the Rel-8 specification was frozen and equipment supporting the standard began trickling out in 2009.

LTE uses OFDM for the downlink – similar to 802.11g and WiMAX – but SC-FDMA for the uplink – to conserve power. Like cellular, most LTE implementations will split the spectrum into paired up/down channels, less asymmetrical by nature than TDD-based WiFi or WiMAX.

LTE uses OFDM for the downlink – similar to 802.11g and WiMAX – but SC-FDMA for the uplink – to conserve power. Like cellular, most LTE implementations will split the spectrum into paired up/down channels, less asymmetrical by nature than TDD-based WiFi or WiMAX.

Both WiMAX and LTE, it should be noted, have specs that will support both TDD and FDD. LTE is designed for licensed spectrum, while WiMAX can utilize a larger variety of licensed and unlicensed bands. Both have organizations to insure interoperability between vendors.

LTE won’t happen overnight. The GSM Association says there are now some 167 million HSPA connections worldwide. AT&T had a 21 percent share of the global HSPA customer base with more than 28.6 million HSPA subscriptions, as of mid-year 2009.

LTE supporter Ericsson expects 80% of mobile broadband services will be enabled by cellular by 2012, using HSPA and LTE technologies. But the bulk of mobile broadband deployments in the coming five years will be based on HSPA, according to Ericsson. They forecast 3.5 billion high-speed access lines globally, about 80 percent of which would be via wireless, rather than fixed. Of the 3 billion mobile broadband lines, about 70 percent will be HSPA, predicts Ericsson.

Wireless Intelligence claims that 58 mobile operators worldwide have already committed to LTE plans, trials or deployments. Up to another 17 LTE networks are anticipated to be in service by the end of 2010 in the U.S., Canada, Japan, Norway, South Korea, South Africa, Sweden, Armenia and Finland, according to data from the Global Mobile Suppliers Association.

6. Carriers commit to LTE (2009):

Verizon Wireless says it expects to commercially launch its LTE 4G network in up to 30 markets in 2010, covering 100 million people with full nationwide coverage in 2013. The company successfully completed its first Long Term Evolution (LTE) data call in Boston, in August, 2009, using 3GPP Release 8. The company also completed an LTE 4G data call in Seattle. Verizon says its LTE network will deliver speeds between 5 Mbps and 12 Mbps. Verizon’s plans LTE dongles on their 700 MHz band next year.

Telenor, Norway’s largest mobile operator with 2.98 million subscribers and a 55 percent market share, announced in November that it will replace its entire mobile infrastructure in its home market of Norway, with Huawei and Starent gear for its LTE network.

Telenor, Norway’s largest mobile operator with 2.98 million subscribers and a 55 percent market share, announced in November that it will replace its entire mobile infrastructure in its home market of Norway, with Huawei and Starent gear for its LTE network.

Wireless Intelligence claims that 58 mobile operators worldwide have already committed to LTE plans, trials or deployments. Up to another 17 LTE networks are anticipated to be in service by the end of 2010 in the U.S., Canada, Japan, Norway, South Korea, South Africa, Sweden, Armenia and Finland, according to data from the Global Mobile Suppliers Association.

7. LTE launched (2009):

The first full commercial Long Term Evolution service was launched this December, by Swedish cellular operator TeliaSonera. The carrier plans to expand 4G coverage to 25 cities in Sweden and four in Norway by the end of 2010.

TeliaSonera became the first operator in the world to launch LTE commercially and has three nation wide 4G/LTE licenses; in Sweden, Norway and Finland. TeliaSonera’s LTE service will cover around 400,000 people in the centres of Stockholm and Oslo. It will first introduce the services in the largest cities in Sweden and Norway, followed by sites in Finland, where it recently received an LTE licence. TeleSonera said it hopes to get the licence for a Danish rollout early in 2010.

TeliaSonera became the first operator in the world to launch LTE commercially and has three nation wide 4G/LTE licenses; in Sweden, Norway and Finland. TeliaSonera’s LTE service will cover around 400,000 people in the centres of Stockholm and Oslo. It will first introduce the services in the largest cities in Sweden and Norway, followed by sites in Finland, where it recently received an LTE licence. TeleSonera said it hopes to get the licence for a Danish rollout early in 2010.

Until 1 July 2010, TeliaSonera is applying no data cap, but after that date it will put a 30GB-per-month cap in place.

They are using the 2.6GHz band and Ericsson RBS6000 base stations, an Evolved Packet Core network, and a mobile backhaul solution including Redback SmartEdge 1200 routers.

They are using the 2.6GHz band and Ericsson RBS6000 base stations, an Evolved Packet Core network, and a mobile backhaul solution including Redback SmartEdge 1200 routers.

It has a theoretical maximum speed of 100Mbps with real-world speeds of 20-80Mbps, according to Johan Wibergh, senior vice president and head of Ericsson’s business unit for networks. That’s about 10 times faster than predecessor HSDPA.

Meanwhile, competitor Net4Mobility, the Swedish joint venture of Tele2 and Telenor will build a national LTE network in Sweden, snubbing Sweden’s Ericsson.

Telenor is the seventh largest carrier in the world, with 172 million subscribers, will replace its entire mobile infrastructure in its home market of Norway, with Huawei and Starent gear. The six-year agreement includes the delivery of multi-base stations for 2G, 3G/UMTS and 4G/LTE.

Verizon Wireless says it expects to commercially launch its LTE 4G network in up to 30 markets in 2010, covering 100 million people with full nationwide coverage in 2013. The company successfully completed its first Long Term Evolution (LTE) data call in Boston, in August, 2009, using 3GPP Release 8. The company also completed an LTE 4G data call in Seattle. Verizon says its LTE network will deliver speeds between 5 Mbps and 12 Mbps.

Verizon Wireless says it expects to commercially launch its LTE 4G network in up to 30 markets in 2010, covering 100 million people with full nationwide coverage in 2013. The company successfully completed its first Long Term Evolution (LTE) data call in Boston, in August, 2009, using 3GPP Release 8. The company also completed an LTE 4G data call in Seattle. Verizon says its LTE network will deliver speeds between 5 Mbps and 12 Mbps.

The difference between Verizon and TeliaSonera is that Verizon is using the 700 MHz band and has 10 MHz of radio spectrum each for the uplink and the downlink. TeliaSonera is using the 2.6 GHz band and has 20 MHz available for each channel.

LTE outperforms baseline HSDPA by a factor of ten. The performance gain of LTE comes mainly from the wider frequency band (up to 20MHz compared to 5 MHz for UMTS), a switch from CDMA to OFDM, and MIMO. But multiple 700 MHz antenna elements may not fit into tiny dongles or handsets and Verizon only has 10 MHz available. Verizon’s LTE data performance therefore may be similar to Sprint’s WiMAX.

8. WiMAX vrs LTE (2006-2010):

LTE and WiMAX are more alike than different. They come in duplex and time division flavors. They provide voice and data. They share technologies like OFDM and MIMO. LTE is the obvious successor to 3G while WiMAX has advantages for developing economies. WiMAX doesn’t require licensed spectrum. That’s advantageous for fixed broadband.

Rapidly developing countries, including China and India, will set the agenda.

With 4.6 billion cellular users in the world, LTE’s prospects look promising. Some observers say that China will go directly to LTE, bypassing WiMAX. Major Chinese telecommunications players, including China Mobile and Huawei, are believed to be working hard to step up to LTE in a year or two. India seems more likely to go with WiMAX.

It’s spectrum that matters. All you have to do see how 4G spectrum is allocated. Most of the 4G space on the 2.6 GHz band, has 140 Mhz dedicated to LTE-like FDD services for much of the world, and 50 Mhz devoted to TDD-like WiMAX services. Maybe that’s how it will shake out.

9. 4G Devices (2009):

Technology is irrelevant to consumers, who pick a carrier based on cost, coverage, devices and applications. Devices and applications have become huge.

The iPod has sold more than 225 million units and the iTunes Store has sold 6 billion songs, accounting for 70% of worldwide online digital music sales and making the service the largest legal music retailer.

Apple’s explosive iPhone shows no sign of slowing down. With 100M Smartphone users expected by 2013, the potential to get rich quick is stimulating developers to produce amazing applications. Yankee Group estimates that nearly 7 billion U.S. smartphone app downloads will garner $4.2 billion in revenue by 2013 with the number of smartphone users set to quadruple to 160 million by then.

Android, Moblin, and Chrome OS may be the gateway drug to WebApps with HTML 5 features, embedded video and audio.

Cisco says bandwidth demands are just beginning an upward curve, with mobile video expected to be a huge factor in the future. Imagine the impact mobile video players, 2-way video phones, multi-media e-books, connected autos, home theatre, smart grid monitoring and hundreds of applications not even conceived of will have in the next decade.

It boggles the mind.

10. 100 Mbps Mobile (2009): The ITU is seeking proposals for “true” 4G wireless broadband standard, which they call IMT-Advanced, the next generation. The ITU requires 100 Mbps (mobile) and 1 Gbps (fixed) speeds. Both the cellular-based LTE-Advanced, and the WiMAX-based 802.16m Advanced (WiMAX 2.0) standards are likely to be approved by the ITU. China is likely to lobby for Time Division LTE.

The ITU is seeking proposals for “true” 4G wireless broadband standard, which they call IMT-Advanced, the next generation. The ITU requires 100 Mbps (mobile) and 1 Gbps (fixed) speeds. Both the cellular-based LTE-Advanced, and the WiMAX-based 802.16m Advanced (WiMAX 2.0) standards are likely to be approved by the ITU. China is likely to lobby for Time Division LTE.

The IEEE submitted IEEE 802.16m for IMT-Advanced standardization in the Radiocommunication Sector of the International Telecommunication Union (ITU-R).

Samsung and Yota are testing Mobile WiMAX 2.0 (IEEE 802.16m) right now. By using 4X2 MIMO in an urban microcell, and 20 MHz TDD channel (double the usual 10 MHz), the 802.16m system can support both a 120 Mbit/s downlink and 60 Mbit/s uplink per site simultaneously, says the WiMAX Forum. The LTE-Advanced camp may follow closely behind, with 100 Mbps upgrades to the current “4G” standards as early as mid-decade.

Samsung and Yota are testing Mobile WiMAX 2.0 (IEEE 802.16m) right now. By using 4X2 MIMO in an urban microcell, and 20 MHz TDD channel (double the usual 10 MHz), the 802.16m system can support both a 120 Mbit/s downlink and 60 Mbit/s uplink per site simultaneously, says the WiMAX Forum. The LTE-Advanced camp may follow closely behind, with 100 Mbps upgrades to the current “4G” standards as early as mid-decade.