The WiMAX Forum, meeting in Ft. Lauderday Florida this week, announced the number of WiMAX deployments has reached 518 networks in 146 countries. Almost two million mobile WiMAX subscribers are expected by the end of 2009, says ABI Research.

Among the Forum announcements:

- Russia’s Yota WiMAX network reports more than 200,000 subscribers since its commercial service launch in July 2009 and hit the break even point for its network.

- Malaysia’s Packet One Networks has topped 130,000 subscribers in its first year of service. In August 2008, P1 became the first company to launch commercial WiMAX services in Malaysia.

- UQ Communications, the Japan-based Mobile WiMAX service provider has contracted with Samsung for additional mobile WiMAX gear. YOZAN uses WiMAX as a backbone for its public Wi-Fi service. UQ says by March 2013, more than 93 percent of the population will be covered with Wimax.

- Clear announced multiple U.S. city launches and nearly 200,000 subscribers to-date. Clearwire’s WiMAX service currently reaches about 30 million U.S. residents. The company plans to reach about 120 million people by the end of 2010.

Regionally, Africa led with 110 deployments and Central/Latin America closely followed with 102 deployments. Asia Pacific reached 82 deployments and Western Europe and Eastern Europe host 69 and 84 networks. North America and the Middle East grew to 51 and 20 deployments, respectively. There are currently 145 WiMAX deployments across both North and South America.

By the end of 2010 WiMAX Forum projects that WiMAX technology will cover at least 800 million people.

The WiMAX Forum called for the Indian government to enable the 2.5 GHz auction to happen on schedule in January 2010 and take steps to release spectrum for WiMAX deployments in the 2.3/2.5 GHz frequency bands. According to the WiMAX Forum, every six months of delay in the auction process translates into USD $1 billion in lost revenue to the country’s economy. Today, there are 500 million mobile phone subscribers in India, but only 7.4 million have access to broadband connections.

India is the world’s second-largest mobile market and is adding around 10 million new subscribers a month. However, the market supports over ten mobile networks and prices are among the lowest in the world.

The Indian auction, scheduled for Jan 14, 2010, has now been postponed until mid-Feb 2010, due to lack of available spectrum at this moment. India’s Department of Telecommunications needs more time to allocate the required frequencies. The DoT announced in Aug 2009 that it will issue four 3G and three WiMAX spectrum slots nationwide. The auctions are expected to fetch more than INR250 billion (US$5 billion).

According to Infonetics Research, WiMAX will accrue nearly 28 million Indian subscribers by 2013 –exceeding the combined WiMAX subscribers in Brazil, China and Russia. Maravedis predicts 13 Million WiMAX Subscribers in India by 2013.

BSNL, Tata and Bharti Airtel are currently deploying WiMAX in the 3.5 GHz band, but the new 2.2-2.3 Ghz band, should lower costs and improve service. There is a school of thought which believes that since there is so much delay in the launch of 3G in India, operators can go directly to LTE, rather than use the band for 3G cellular.

In other news:

- Towerstream announced the launch of its tenth market in Philadelphia, PA. Philadelphia is the fifth most populated metropolitan area in the country, behind other Towerstream markets New York City, Los Angeles, Chicago and Dallas-Fort Worth. Towerstream provides high speed wireless backhaul for businesses.

- Beceem Communications announced today a number of Uplink performance improvements to the company’s WiMAX chips. The 4G Turbo improvements enhance network coverage and user experience, especially at the cell edge and in areas of low signal strength. Beceem is on track to ship three million chips, “capturing more than 70 percent market share,” said Lars Johnsson, Vice President of Marketing at Beceem.

- Greenpacket announced new modems including the DX Wimax Indoor VoIP modem with directional antennas and built-in VoIP support. The Tower can be used for both home and SOHOs and it is a plug ‘n play device. The Green Packet ‘Shuttle’, a WiMax USB High Gain Modem is the world’s first high gain USB modem supporting both fixed and nomadic WiMAX.

WiMAX and LTE are in a death race to provide true broadband wireless. Many believe cellular-backed LTE will win this battle based on shear numbers — there are currently over 4 billion wireless users.

Verizon says it will launch 25 to 30 markets in mid-to late-2010 and will support average data rates per user of 5-12 Mbps (down) and 2-5 Mbps (up).

Verizon went for 700 MHz spectrum because of the coverage that is required for a nationwide network, explained Verizon’s Chris Neisinger at the WiMAX confab this week. Verizon agreed to pay almost $10 billion for 700 MHz C-Block spectrum during the FCC’s auction last year. Verizon says they’ll have 100 million POPs covered with LTE by year-end 2010 (which may be optimistic since they have zero now). Clearwire, which has 30 million POPs now, says they’ll cover 120 million by the end of 2010.

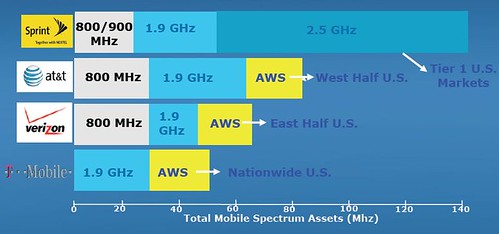

Clear has some 120 Mhz available at 2.5GHz while Verizon is restricted to about 12Mhz on the 700 MHz band. Barry West, president of Clearwire International, says most wireless consumers used on average around 30 megabytes per month, but the current average is around 1 gigabyte per month, and he expects the average consumer will use 14 gigabytes per month in the near future.

Analyst Alan Weissberger believes that pure performance and coverage are insufficient by themselves to attract a large number of subscribers to WiMAX.

Verizon’s planned LTE dongles on their 700 MHz band next year will likely be tied to data caps. A typical monthly mobile broadband plan for a netbook or dongle costs $60 a month, far more than the $15-$30 Verizon, AT&T and Sprint charge for tethering. Unlike Clear, FDD-based LTE is not likely to offer unlimited 3 Mbps service for $30/month.

They don’t have the spectrum.

Comcast’s data usage meter in Portland, Oregon, show customers how much data they consume in a month. Comcast has a 250GB per month limit, compared to the 5GB per month imposed by all the cellular carriers (except Clear WiMAX). AT&T charges $.48 per MB over 5 GB. That’s $250 extra if you use 10GB/month.

That would eliminate the home market for LTE. That’s okay with AT&T and Verizon. It doesn’t help universal access, but that’s not their problem. Maintaining the cash flow of legacy networks is job one for cellular providers.

Clearwire, on the other hand, expects to grow its WiMAX customer base in the United States to approximately 600,000 by the end of 2010. It has the disruptive advantage of bandwidth and a flexible, cost-effective, all-IP backbone.

Juniper predicts 50 million WiMAX subscribers globally by 2014 but LTE subscribers will exceed 100 million by 2014. Maravedis predicts 75 million BWA/WiMAX subscribers by 2014. ABI research forecasts LTE subscribers to reach 32.6 million by 2013. Yankee Group expects global WiMAX subscriptions to grow from 3.9 million today to 92.3 million in 2015. GSMA predicts 87M LTE Subs by 2014 but that HSPA 3G networks will provide a big cushion to fall back on.

LTE is likely to provide voice support in 2011 (even if it is shunted through traditional cellular channels). A WiMAX VoIP phone in that same time frame wouldn’t have comparable voice coverage. Clearwire has a self-imposed deadline for WiMax smartphones by Christmas 2010, according to Clearwire CEO Bill Morrow. Both “4G” phones will need dual band chips to deliver ubiquitous voice and data — in the later half of 2011.

Comcast could be a game changer. It’s Sprint’s CDMA all over again. New bottle. New wine. With TV.

No comments:

Post a Comment