Huawei has made the cut as a supplier to Clearwire WiMAX network, reports the WSJ.

Under the three-year deal, Huawei will supply WiMax gear to Clearwire. Clearwire currently uses Motorola and Samsung gear and planned to use infrastructure from Nokia Networks, until they dropped their WiMAX development. Cisco’s WiMAX unit, which bought beamforming innovator Navini Networks, will also provide equipment to Clearwire.

Under the three-year deal, Huawei will supply WiMax gear to Clearwire. Clearwire currently uses Motorola and Samsung gear and planned to use infrastructure from Nokia Networks, until they dropped their WiMAX development. Cisco’s WiMAX unit, which bought beamforming innovator Navini Networks, will also provide equipment to Clearwire.

Baltimore’s Xohm service uses ZyXEL 206M2 residential clients and Samsung’s SWC-E100 express card. Clear uses clients by Motorola as well as infrastructure.

Clear plans to expand to 80 markets by the end of 2010, deploying roughly 20,000 base stations at a cost of $150,000 each. Huawei has sold gear to 45 WiMax networks around the world. Clearwire’s CTO John Saw said that Huawei was chosen because of its ability to support a wide-reaching deployment at a low cost.

The giant Chinese telecom vendor, will gain a major foothold in the United States and may help it’s LTE thrust for cellular operators. Huawei faces little competition in the market for LTE gear, opines Om Malik, with Nortel and Alcatel-Lucent in financial difficulty. Vodafone will use Huwaei gear in its LTE trials. Vodafone Germany and Huawei will test the performance of LTE in the 790-862MHz band using Huawei’ s end-to-end LTE solution and opened their Long Term Evolution laboratory in Richardson, Texas. Huawei is a 100% employee-owned company with no Chinese government ownership. Ericsson is currently the largest LTE proponent.

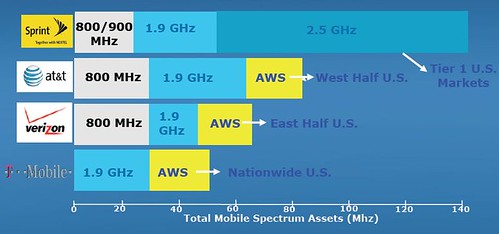

Clearwire has spectrum — some 120 MHz of greenfield spectrum in major cities. If Clear could re-sell some of that asset to LTE-based cellular carriers, they would be sitting pretty. Carriers don’t want to become a “dumb” pipe — not even Clear.

Clear could fight cellular Goliaths — or make money on them.

In June, Huawei launched what it proclaimed the world’s first commercial WiMax distributed base station (DBS) with four transmitters and four receivers (4T4Rs). With better coverage, operators may reduce the number of base stations and lower their total cost of ownership.

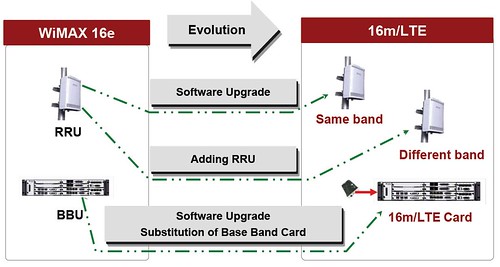

Huawei’s equipment is compatible with multiple kinds of wireless technology. That includes what the other carriers are deploying, said Charlie Chen, a marketing and product management executive for Huawei. Huawei’s WASN9770 can provide end-to-end funtionality and supports profile C from the WiMAX Forum. Clearwire could conceivably change technologies down the line if it needed to.

Profile C, as defined by the Wimax forum Network Working Group (archive), stipulates an open and non-proprietary interface standard between basestations (BTS) and the internet gateway (ASN Gateway). Profile C operators are not tied into one vendor for BTS and ASN Gateway equipment.

The WiMAX Forum hopes to break the classic 2G/3G closed architecture model and standardize on Profile C. That enables operators to deploy radio and network equipment from different vendors based on a single “R6″ interface. The “open” approach allows easier handoff between different service providers who can use gear from different vendors.

Despite the apparent advantages of Profile C, some ‘turnkey’ vendors are still successfully tempting operators with two non-open approaches between the BTS and ASN Gateway: Profile A and Profile B. Both Profiles can create vendor lock-ins.

- Profile A: WiMAX-defined standard interface between ASN gateway and base station, with more radio resource control functions in the ASN gateway. Alcatel-Lucent is an advocate of Profile A, which must have the same supplier for both the BTS and the ASN Gateway.

- Profile B: No defined interface between ASN gateway and base station. WiMAX suppliers like Cisco started out with profile B (through its acquisition of Navini Networks), but is now shifting to Profile C.

- Profile C: WiMAX-defined standard interface between ASN gateway and base station. It has more radio resource functions in the base station and a focus on the air interface. Alvarion supports Profile C and continues to promote OPEN WiMAX approach (pdf) in their open WiMAX architecture.

Some companies (like Motorola), are said to have hardware pieces that are difficult to change to an “open”, Profile C. For some operators, if the price and performance is right, Profile A or B can be a reasonable (if not ideal) solution, despite the vendor lockdown.

Ericsson expects 80% of mobile broadband services will be enabled by cellular by 2012, using HSPA and LTE technologies. Ericsson CEO Carl-Henric Svanberg said the bulk of mobile broadband deployments in the coming five years will be based on HSPA. According to Unstrung, Svanberg forecast 3.5 billion high-speed access lines globally, about 80 percent of which would be via wireless, rather than fixed. Of the 3 billion mobile broadband lines, about 70 percent will be HSPA, predicts Ericsson.

No comments:

Post a Comment