3G Americas, a wireless industry trade association representing GSM cellular technologies, today announced that it has published an educational white paper titled, “MIMO and Smart Antennas for 3G and 4G Wireless Systems” (pdf) The report is a tutorial reference document that outlines smart antenna schemes for improving the capacity and coverage.

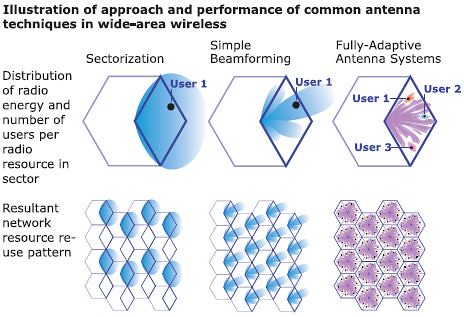

The term smart antennas (Wikipedia) refers to adaptive array antennas that can follow relatively slow-varying traffic patterns; intelligent antennas, which can form beams aimed at particular users or steer nulls to reduce interference; and MIMO antenna schemes, predominately featured in LTE and WiMAX systems.

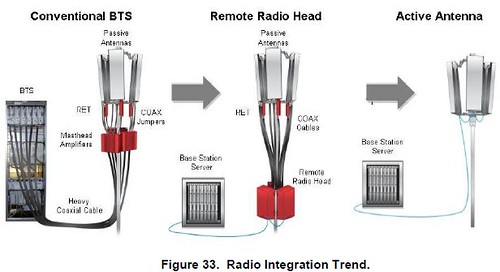

MIMO systems use multiple transmit and receive data paths for faster data throughput and/or link range. Beamforming is a key component of the time division duplex (TDD) versions of 3GPP LTE (TD-LTE) and WiMAX 802.16e specifications. Frequency Division Duplex (FDD), used by Verizon and AT&T in the 700 MHz band, would be impractical since it would require twice as many antenna components and much larger client devices.

The white paper was created by a 3G Americas technical work group and concentrates on the practical aspects of antennas and their deployment for 3G and 4G wireless systems, specifically downlink antenna techniques available in 3GPP LTE Release 8.

Some of the areas addressed in the paper include:

- Peak data rates tend to be proportional to the number of send and receive antennas, so 4X4 MIMO is theoretically capable of twice the peak data rates as 2X2 MIMO systems. For another example, in upgrading from HSPA (1X2) to LTE (2X2) a gain of 1.6x is seen (Rysavy Research, 2009).

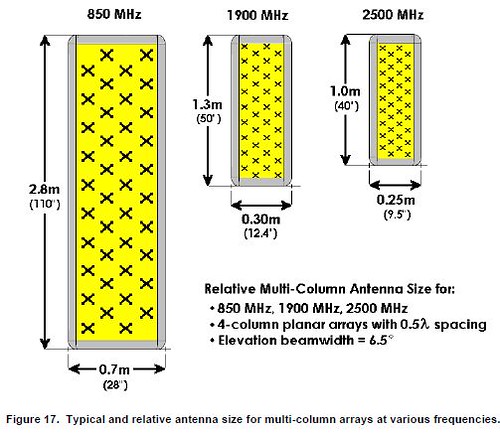

- The practical tradeoffs of performance with the realistic constraints on the types of antennas that can be realistically installed, cognizant of zoning, wind loading, size, weight and cabling challenges and constraints from legacy terminals and other equipment.

- 3GPP Release 8 of the LTE standard supports MIMO antenna configurations. This includes Single-User (SU-MIMO) protocols using either Open Loop or Closed-Loop modes as well as Transmit Diversity and MU-MIMO. Closed-Loop MIMO mode, which supports the highest peak data rates, is likely to be the most commonly used scheme in early deployments. However, this Closed-Loop MIMO scheme provides the best performance only when the channel information is accurate, when there is a rich multipath environment and is appropriate in low mobility environments such as with fixed terminals or those used at pedestrian speeds.

At 700 MHz, a 2X2 configuration (two transmitters and two receivers) is most common. A 2X4 configuration is preferred at higher frequencies between 1900 MHz and 2600 MHz. At 2300 MHz, an 8X8 installation for TDD-LTE is expected to be widely deployed.

Beamforming and adaptive arrays in the 700MHz band seem unlikely. There simply isn’t room for multiple very large antennas per sector. They’d also create excessive wind load. Most LTE and WiMAX deployments will be in the 2.3, 2.6 and 3.5 GHz bands. Less size. More bandwidth.

Huawei’s green basestations increase the efficiency 30%, says the company, with a smooth evolution to WiMAX 16m, with 100Mbps in each sector, using only software upgrades and board swaps. Motorola says WiMAX can eliminate air-conditioned equipment sheds, reducing construction costs 35 percent and power 60 percent (pdf).

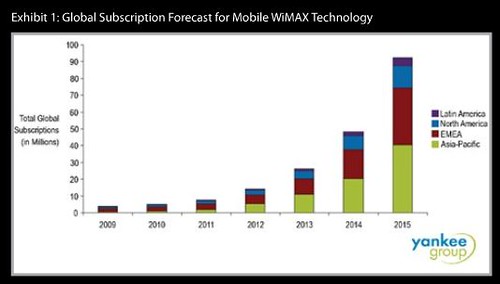

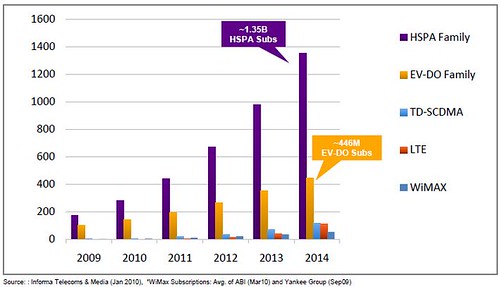

Yankee Group projects about 50 million WiMAX subs by 2014. Juniper Research predicts 100 million LTE subs by 2014, a figure that matches an earlier Maravedis projection of WiMAX subscribers by 2014. Cumulative (3G + 4G) wireless broadband subs are expected to exceed 2 billion world-wide by 2014.

An Intel whitepaper (pdf) claims WiMAX technology is more spectrally efficient than HSPA or LTE. The report compares Mobile WiMAX with HSPA, HSPA+, and LTE. Intel says WiMAX can handle more subscribers per cell site with higher QOS.

According Intel’s report, WiMAX is able to support 20 video streaming users per sector at 256 kbps, using a 10MHz channel, compared to 12 users at 128 kbps on an HSPA network. Furthermore, WiMAX networks are able to support a large number of users even with high monthly data usage of 12GB per subscriber.

Meanwhile, Rysavy Research white papers (pdf) shows another look at relative spectrum efficiency. It was created by cellular-centric 3G Americas’ members and compares 5+5 MHz for UMTS-HSPA/LTE and CDMA2000, with 10 MHz DL/UL=29:18 TDD for WiMAX.

The above chart does not include WiMAX Release 2 (802.16m) which has a spectral efficiency of 2.6 bits/sec/Hz, which would be higher than LTE.

WiMAX Release 2 (802.16m) will use 4X2 MIMO in urban microcells, in a single 20 MHz TDD channel. The WiMAX Forum expects to see WiMAX Release 2 available commercially in 2011-2012. Beceem and Sequans make TD-LTE and 16m chips for dongles.

Japan’s UQ Communications with more than 300,000 WiMAX subscribers by the end of the 2009, plans several million subscribers in the coming years with coverage of more than 90% of the Japanese population by 2012. UQ Communications says it has installed 7,013 WiMAX base stations in 447 municipalities and in 111 train stations operated by East Japan Railway Company.

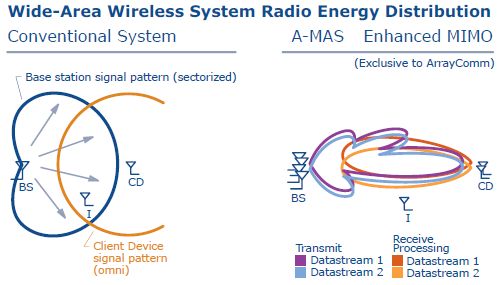

UQ Communications features NEC’s Mobile PasoWings base stations with ArrayComm A-MASTM multi-antenna signal processing software. ArrayComm is a world leader in Multi-Antenna Signal processing that combines MIMO, beamforming, and interference cancellation.

Samsung and Yota are now testing 802.16m.

Clearwire, UQ, and Yota offer WiMAX roaming between countries, providing their users with 4G access when abroad.

Clearwire, UQ, and Yota offer WiMAX roaming between countries, providing their users with 4G access when abroad.

The three companies will also be among the first to move to 802.16m (WiMAX 2.0), which utilizes 4×4 MIMO and 20 MHz wide channels to deliver 120 Mbps mobile service.

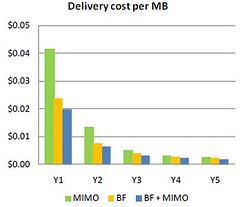

Cisco sponsored studies (right), found WiMAX Operators could cut network costs in half by using beamforming systems (pdf). Azimuth Systems, a leading provider of wireless testing solutions, offers a series of beamforming seminars.

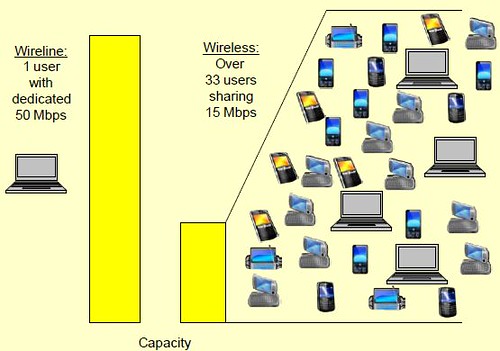

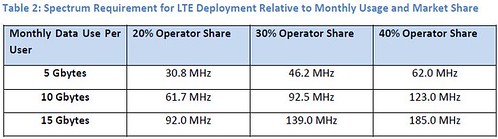

Verizon Wireless’ LTE network will operate in the 700 MHz band using 10 MHz radio channels, with a spectral efficiency of 1.5 bps/Hz. That means LTE can deliver a sector throughput of 15 Mbps — but it must be shared by some 30 users in a sector. Clearwire says that the average subscriber is now using about 7 GB per month.

That’s a problem for 700 MHz LTE. Demand is likely to exceed their 20 MHz capacity (10 MHz x 2) — which means data caps and higher costs for LTE. Don’t plan on a telephone hotspot option (now available on Sprint’s $199 EVO 4G phone). LTE phones won’t be available for at least a year, and any mobile hotspot option would likely cost more than $30/month.

Clearwire has up to 120 MHz of spectrum available – four to six times the capacity that Verizon or AT&T have on 700MHz. In addition, WiMAX 2.0 should deliver average downlink speeds in excess of 100Mbps per sector by this time next year using 20 MHz in each of three sectors. That’s another 2-3 times the capacity & speed – and it will be backwards compatible with their current WiMAX network.

Samsung’s new U-RAS Flexible base station will be used by Clearwire this year. It supports 802.16e, 802.16m, as well as both FDD-LTE and TD-LTE deployments.

Even cellphones are now used more for data than for calls. In a data-driven world, FDD broadband wireless is a waste of space. TD-LTE brings BWA inside the cellco tent. That’s why cellular companies like it.

It’s high noon in Boston. The city will soon have a shootout between Verizon’s LTE and Clear’s WiMAX. But consumers are agnostic.

No comments:

Post a Comment