Southeast Asia’s first 4G operator, Packet One Networks, launched its WiMAX service in Malaysia in August 2008 and is now preparing to transition to LTE.

Southeast Asia’s first 4G operator, Packet One Networks, launched its WiMAX service in Malaysia in August 2008 and is now preparing to transition to LTE.

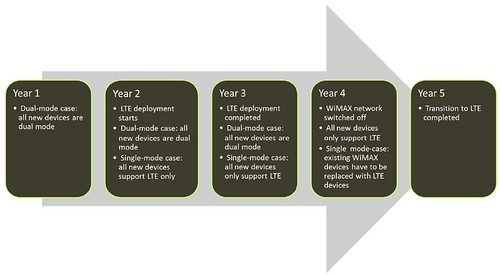

Packet One, a wireless ISP, expects to begin a transition to a full LTE network in 2013. Packet One, a subsidiary of Greenpacket, and a leading developer of 4G systems, is testing a dual-mode 4G WiMAX/LTE solution from Sequans for dual-mode WiMAX/LTE, and hopes to launch a complete ecosystem of 4G networking solutions and devices by the end of 2011.

Gemtek’s new TD-LTE indoor CPE is based on Sequans’ SQN3000 series LTE chips, which support up to 100 Mbps throughput and 20 MHz channels. “We expect the new CPE to begin commercial deployment in the third quarter of 2011,” said James Ting, GM, Broadband Wireless Business Unit, Gemtek.

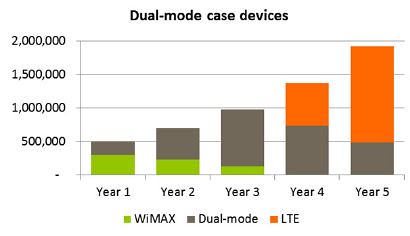

“As Southeast Asia’s leading 4G operator, first for WiMAX and now for dual-mode WiMAX and LTE, P1 has three years of experience operating an end-to-end 4G network,” said Michael Lai, P1 CEO. Packet One uses 30MHZ of its 2.3GHz spectrum for WIMAX, but plans to re-farm 20MHz of this for LTE leaving 10MHz for its legacy WIMAX subscribers. This will happen in a gradual process over the next two years, Lai says.

“As Southeast Asia’s leading 4G operator, first for WiMAX and now for dual-mode WiMAX and LTE, P1 has three years of experience operating an end-to-end 4G network,” said Michael Lai, P1 CEO. Packet One uses 30MHZ of its 2.3GHz spectrum for WIMAX, but plans to re-farm 20MHz of this for LTE leaving 10MHz for its legacy WIMAX subscribers. This will happen in a gradual process over the next two years, Lai says.

Greenpacket is testing Sequans’ system-on-chip technology to develop LTE reference designs, including a dual-mode WiMAX/LTE reference design for operator customers primarily in Asia, CALA and Middle East, according to James Wang, Senior Vice President of at Greenpacket. “We intend to offer our solutions to early adopters of LTE such as P1 in support of its LTE/WiMAX coexistence strategy.”

Sequans’ recently announced their 4Sight program, to help mobile operators transition smoothly and cost-effectively from WiMAX to LTE and enable harmonious WiMAX/LTE coexistence.

P1 was the first large-scale commercial 4G WiMAX deployment in Southeast Asia, and the first large-scale deployment of an 802.16e 2.3GHz WiMAX network outside Korea. P1 is one of nine Malaysian companies allocated 2.6GHz spectrum. In addition to Sequans, Packet One also announced TD-LTE collaborations with China Mobile, Qualcomm & ZTE.

Packet One has a technology cooperation agreement with China Mobile to spearhead Time Division LTE (TD-LTE) in Malaysia and South-East Asia.

“The economies of scale brought by China Mobile, with its subscriber base of over 600 million will see rapid development of the entire TD-LTE ecosystem,” said P1 chief executive officer Michael Lai at the signing ceremony this week. China Mobile is among the first operators to have adopted the TD-LTE technology and it is one of the founders of the global TD-LTE Initiative (GTI).

Clearwire-USA is one of the 20 members of the Global TD-LTE Initiative. Others include Aero2-Poland, Belltell-Philippines, Bharti Airtel-India, China Mobile-China, Datame-Finland, E-Plus – Germany, FarEastone-Taiwan, FITEL-Taiwan, Korea Telecom-Korea, Omantel-Oman, Nextwave-USA, P1-Malaysia, Smoltelecom-Russia, SoftBank-Japan, Tatung Infocomm-Taiwan, Vividwireless-Australia, Vodafone-UK, Voentelecom-Russia and Woosh-New Zealand.

Most WiMAX operators will migrate to LTE, but the pace and modalities of the shift will vary greatly depending on geography, service focus, spectrum availability, and funding, says Monica Paolini (PDF).

ZTE, a global Chinese provider of telecommunications equipment, has completed an interoperability test between TD-LTE terminals and GSM/UMTS/CDMA EV-DO networks, proving their TD-LTE devices can work seamlessly with existing networks. ZTE has deployed TD-LTE trials and commercial networks for 25 leading global operators in 15 countries.

Operators going with TD-LTE include China Mobile, Vivid Wireless in Australia, Yota, in Russia, Global Mobile in Taiwan and Packet One in Malaysia. India will also be a TD-LTE country.

Yota announced that it will cover the next 15 cities on its roll-out list with TD=LTE instead of WiMAX. It will also cover existing markets in Moscow and St. Petersburg with LTE by the end of 2011. Yota will spend $100 million to roll-out LTE in five Russian cities this year, with total investment estimated at up to $2 billion.

“The biggest concern facing many operators now is the squeeze on available spectrum,” says ABI research analyst Fei Feng Seet. “Regulators in certain countries have not yet announced any plans for LTE spectrum allocation.” Countries such as Taiwan will not be ready for such LTE spectrum auctions any time soon, because the 700MHz and 2.6GHz spectrum bands, the most suitable for LTE, are still occupied.

The fix is in. It’s circumstantial evidence that Clearwire and Sprint may go with TD-LTE. Paired spectrum at 2.6 GHz would be a real spectrum hog when moving to next generation LTE-Advanced with 20MHz x 2 channels (using FD-LTE). LTE Advanced includes support for relay node which extends coverage by using the LTE channel for selfbackhaul. Handy for satphone frequencies, too.

Grid Net uses the WiMax protocol, in partnership with Sprint, but some players, like SmartSynch use public cellular networks through partnerships with players like AT&T. Other smart grid companies like Trilliant and Silver Spring, use private mesh networks.

Grid Net uses the WiMax protocol, in partnership with Sprint, but some players, like SmartSynch use public cellular networks through partnerships with players like AT&T. Other smart grid companies like Trilliant and Silver Spring, use private mesh networks.

Clearwire’s “LTE 2X” trials in Phoenix use paired, 20×20 MHz blocks, twice the size Verizon’s LTE. But the economies of scale developing around TD-LTE may be compelling for Sprint.

No comments:

Post a Comment